Aspire stands ready to provide the business owner, entrepreneur and site selector with key information on Johnson County and the Southern Indianapolis region. Our staff understands the importance of confidential, quick and correct information that is available when you need it, helping navigate the expansion and incentive process.

// LOCATION

The center of Johnson County, Indiana is located 18 miles from Downtown Indianapolis and 22 miles from the Indianapolis International Airport. Our location allows for a distribution company to bring a product from Johnson County to Louisville in an hour and a half, traveling the short distance of 92 miles. The same cargo could also travel 200 miles north and arrive in Chicago in just a little over three and a half hours.

This ease of travel and central location allows Johnson County companies to draw from a 60-mile radius, reaching an estimated workforce of 1,402,840.

Johnson County is home to a variety of industry sectors, including advanced manufacturing, government/defense, retail, healthcare and life sciences, and distribution/logistics. We are proud of our diverse business base and continue to attract a variety of sectors to our business lots.

// REGIONAL PROFILE

Johnson County is part of the Central Indiana region that includes Indianapolis, the nation’s 13th largest city. We are part of a metropolitan area that is a vibrant place for living, visiting and doing business. Our close proximity to Downtown Indianapolis, the Indianapolis International Airport and an extensive interstate network make this community an ideal location for business development.

Johnson County’s regional reach stretches into the Indy Metro counties, in addition to Bartholomew and Brown counties. Johnson County is connected to the region by Interstate 65, which runs north/south along the eastern side of the county. U.S. 31 also runs north/south through the central part of the county.

The Central Indiana region consists of the nine counties surrounding Indianapolis. These nine counties are Boone, Hamilton, Hancock, Hendricks, Johnson, Madison, Marion, Morgan and Shelby.

Central Indiana is one of the fastest-growing metro areas in the Midwest and has been capturing the attention of site selectors and other companies looking for a perfect location to do business.

What they say about Indiana and the Indy Region

Top 5 U.S. States to Do Business, Chief Executive 2019

No. 2 Best State for Business Infrastructure, CNBC 2019

No. 4 Best State for Cost of Doing Business, CNBC 2019

No. 1 in Midwest and No. 10 Nationally for Best State Tax Climate, the Tax Foundation 2020

No. 1 Nationally in Pass-Through Highways, Indiana Economic Development Corporation 2019

No. 1 Among States for Government Efficiency, U.S. News & World Report 2017

// DEMOGRAPHICS

The factors that draw companies to Johnson County are the same reasons individuals choose to call it home. Great employment opportunities, a wide variety of academic options and a low cost of living attract and retain our skilled and diverse workforce.

// BUSINESS CLIMATE

Johnson County is very proud of its pro-business climate. Since 2006, more than 60 companies have relocated here, while an additional 57 companies chose to remain in the county and expand their business.

The State of Indiana also has a solid reputation as a pro-business climate. Chief Executive Magazine ranked Indiana fifth in its 2019 list of best states to do business in, up from sixth the previous year. Indiana was ranked first in the Midwest and continues to be the only Midwest state to make the top-ten list.

// INCENTIVES

LOCAL

Property Tax Abatement

Property Tax Abatement is available to both new and existing companies making an investment in qualifying real and/or personal property. The length of an abatement can be up to 10 years. Incentive evaluation is done on a case-by-case basis, with primary consideration given to capital investment, wages, and new job creation.

Tax Increment Financing

This is a financial tool designed to promote economic development and redevelopment. A geographic area designated as a TIF District collects property taxes in two ways: base revenues and incremental revenues. TIF monies can also be used for a variety of private projects, such as certain building improvements, equipment purchase and/or set-up expenses, and land improvements and/or cost buy-down. Incentive evaluation is done on a case-by-case basis, with primary consideration given to capital investment, wages and new job creation.

Workforce Recruitment Assistance

Johnson County works closely with WorkOne to provide assistance to our companies as needed, such as job fairs.

STATE

The Economic Development for a Growing Economy (EDGE) tax credits are based on the additional employee payroll withholdings for net new job creation in Indiana. The grant may be up to 10 years. Credits are applied against the company’s Indiana income tax liability and are refundable.

HBI

Hoosier Business Investment tax credits are available to a company making a "qualified investment" in an Indiana facility. Generally, a "qualified investment" refers to new buildings, building improvements, and equipment. The credit award may equal up to 10 percent of the qualified investment and may be carried forward for up to nine years. The credit percentage and carry-forward term are determined by the Indiana Economic Development Corporation on a case-by-case basis.

Training Assistance

The Skills Enhancement Fund (SEF) provides financial assistance to new and/or expanding companies interested in training their Indiana resident workforce. Eligible companies can receive reimbursement of up to 50 percent of eligible training costs.

Infrastructure Assistance

The Industrial Development Grant Fund helps communities meet the public infrastructure needs of a new and/or expanding company. Assistance is available for a publicly installed infrastructure leading up to the company’s property, except in the case of rail spurs and fiber-optic cable.

Permitting Assistance

The Indiana Economic Development Corporation’s Office of the Ombudsman can assist companies by serving as a liaison between the company, community, and regulatory agencies in an effort to minimize the amount of time spent on regulatory compliance. The office can also provide permit application assistance and tracking.

Resources

Workforce Development Program - Indiana Department of Workforce Development

Energy Programs - Purdue’s Technical Assistance Program-Energy Efficiency Section

Bonds and Financing - Indiana Finance Authority

// TAXES

According to the Tax Foundation, 2020, Indiana ranks 10th in the Tax Foundation’s State Business Tax Climate Index. The index compares the states in five areas of taxation that impact business:

- Corporate taxes

- Individual income taxes

- Sales taxes

- Unemployment insurance taxes

- Taxes on property, including residential and commercial property

The Tax Foundation ranks neighboring states as follows: Michigan (12th), Illinois (35th), Kentucky (24th) and Ohio (38th).

Corporate Income Tax

- 5.25% of the percentage of adjusted gross income.

Property Tax

- 3% cap of assessed value for real and personal property

- 3% cap for industrial companies

Individual Income Tax

- 3.4% of federal Adjusted Gross Income plus a 1% County Adjusted Gross Income Tax.

Single-Sales Factor

- Phased-in for apportioning corporate income tax, based solely on the portion of a company’s sales in Indiana.

- Gross Receipts Tax - None

- Inventory Tax - None

// OPPORTUNITY ZONES

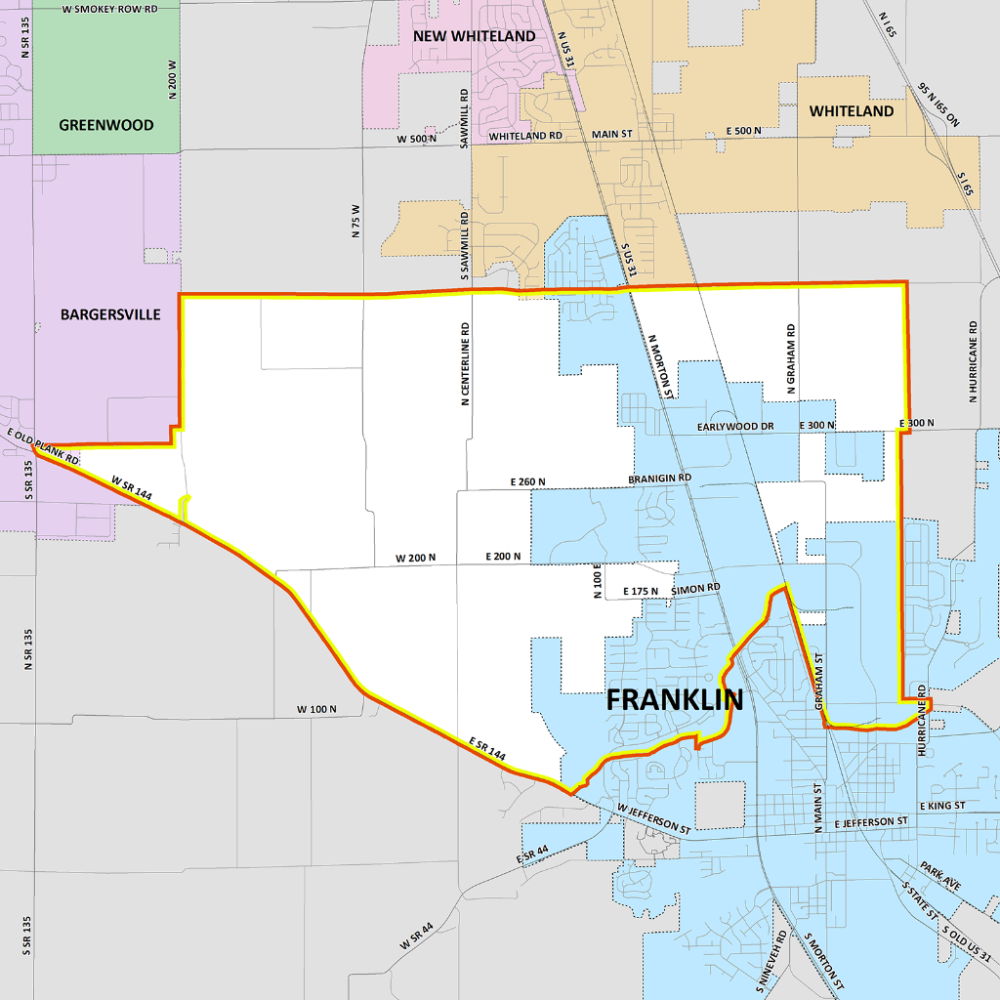

The City of Franklin and part of Johnson County, Indiana, have been designated as one of Indiana's Opportunity Zones.

Created in the 2017 Tax Cuts and Jobs Act, the federal government provides capital gains tax incentives to attract private sector investment in the Opportunity Zones. The designated area in Johnson County includes a large portion of the City of Franklin, the Franklin Business Park, a west corridor to the town of Bargersville, Indiana, and north to Whiteland, Indiana.

Once approved by the U.S. Department of the Treasury, the designations remain in place for 10 years to encourage long-term investment in the selected communities.

The state collected extensive economic data on all eligible census tracts and received close to 2,000 recommendations, including input from 357 local officials, stakeholders, and citizens. The 156 nominated census tracts are located in 58 counties covering all or portions of 83 cities and towns throughout the state. Indiana's Opportunity Zones cover more than 1,000 square miles.